BUSINESS FORMATION CONSULTATIONS

Our BUSINESS FORMATION CONSULTATIONS provide answers to the most common questions contemplated by overseas entrepreneurs when forming a new company in the US:

- In which US state should a new eCommerce or SaaS company be formed?

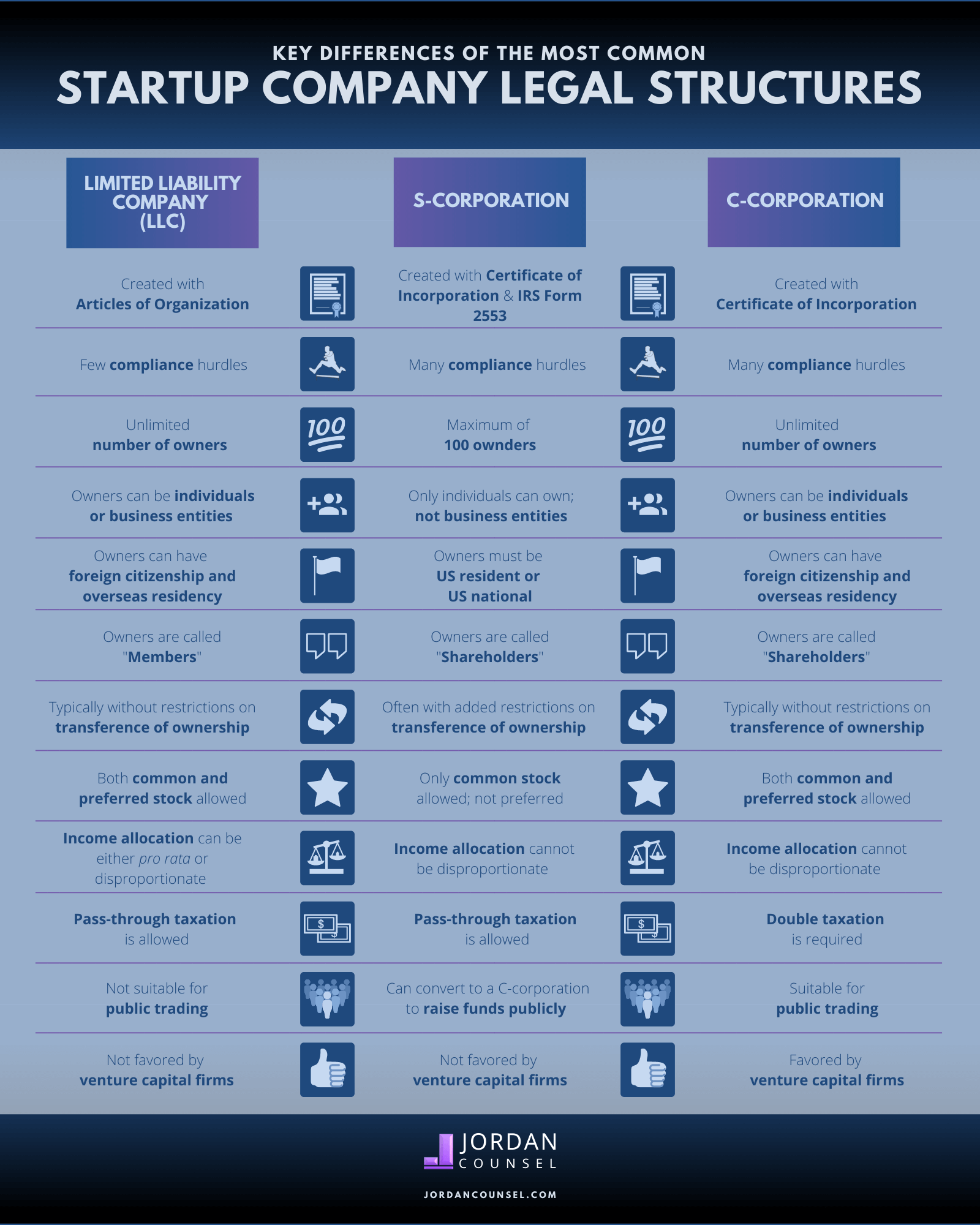

- What legal structure (eg, LLC or corporation) should the new company have?

- What is the role of a corporate registered agent? And is a registered agent necessary?

- What is the purpose of applying for an Employer Identification Number (EIN)? How long is the application process for the EIN?

- What factors determine whether state sales tax must be collected from customers of the new online business?

- How can overseas entrepreneurs open a US bank account from abroad?*

- How can the assets of the overseas parent company receive additional protection?*

- Which US visa options authorize overseas entrepreneurs to go to the US to set up and manage their company?*

*Explained during 60-minute consultations

BUSINESS FORMATION

For single-owner LLCs (managed by owner) our service includes the following:

- Preparation of the following document:

- Articles of organization

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) application

For LLCs with two or more owners (managed by owners) our service includes the following:

- Preparation of the following documents:

- Articles of organization

- Operating agreement

- Submission of founding papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) application

Venture capitalists prefer corporations because of the three defining characteristics of this entity choice: easy transferability of interests, perpetual duration and limited liability. Our service includes the following:

- Preparation of the following documents:

- Certificate of incorporation

- Company by-laws

- Submission of incorporation papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number Application

Venture capitalists prefer corporations because of the three defining characteristics of this entity choice: easy transferability of interests, perpetual duration and limited liability. Our service includes the following:

- Preparation and filing of the following:

- Articles of incorporation for Delaware

- Subsequent qualification in another state

- Employer Identification Number Application

- Preparation of the following documents:

- Company by-laws

This entity choice is available to corporations that are formed for the purpose of creating a material positive impact on society and the environment. Benefit corporations must have a specific public benefit, which by definition includes the following examples:

- providing low-income or underserved individuals or communities with beneficial products or services;

- promoting economic opportunity for individuals or communities beyond the creation of jobs in the normal course of business;

- preserving the environment;

- improving human health;

- promoting the arts, sciences or advancement of knowledge;

- increasing the flow of capital to entities with a public benefit purpose; and

- the accomplishment of any other particular benefit for society or the environment.

Our service includes the following:

- Check availability of proposed Benefit Corporation name

- Preparation of the following documents:

- Certificate of Incorporation

- Corporate Bylaws

- Submission of incorporation papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

This entity choice is available to companies that will create a positive effect, including effects of an artistic, chartable, cultural, economic, educational, environmental, literary, medical, religious, scientific or technological nature.

Our service includes the following:

- Check availability of proposed Public Benefit Corporation name

- Preparation of the following documents:

- Certificate of Incorporation

- Corporate Bylaws

- Filing Certificate of Incorporation with Delaware Secretary of State

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

Not-for-profit companies may be formed either as a Charitable Corporation or a Non-charitable Corporation. Unlike business corporations, a not-for-profit corporation may not be formed for pecuniary profit or financial gain and the corporation’s assets, income or profit generally may not be distributed to or otherwise used to benefit the corporation’s members, directors or officers. Our service includes the following:

- Preparation of the following documents:

- Certificate of Incorporation

- Corporate Bylaws

- Submission of incorporation papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

Any corporation granted an exemption by the IRS as a non-profit organization under Section 501(c) is exempt from Delaware Corporate Income Tax. Non-profit organizations include, but are not limited to:

- Fraternal beneficiary societies,

- Orders or associations, cemetery corporations and corporations organized or trusts created for religious, charitable, scientific or educational purposes or for the prevention of cruelty to children or animals, home owner associations,

- Business leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, as well as clubs organized and operated exclusively for pleasure, recreation and other non-profit purposes.

Our service includes the following:

- Preparation of the following documents:

- Certificate of Incorporation

- Corporate Bylaws

- Filing Certificate of Incorporation with Delaware Secretary of State

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

This entity choice is available for engineers, architects, physicians, lawyers, dentists and other professions specified by the Department of Education. Our service includes the following:

- Preparation of the Articles of Organization

- Submission of founding papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

This entity choice is available for founders who are licensed or otherwise legally permitted to practice a professional service, including physicians, lawyers and other professions specified by the NY Department of Education. Our service includes the following:

- Check availability of proposed LLP name

- Preparation of Certificate of Registration

- Submission of founding papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

This entity choice is available to companies that will provide professional services in engineering and/or architecture and/or land surveying and/or landscape architecture. Our service includes the following:

- Check availability of proposed Design Professional Corporation (DPC) name

- Preparation of the following documents:

- Certificate of Incorporation

- Moral Character Attestations (for unlicensed shareholders)

- Submission of incorporation papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

One or more professionals may form a professional service corporation (P.C.) for the purpose of rendering the professional service or services that the professionals are authorized to practice. This entity choice is specifically available for engineers, architects, accountants, physicians, lawyers, veterinarians and chiropractors in NY. Our service includes the following:

- Check availability of proposed Professional Service Corporation (PC) name

- Preparation of the following documents:

- Certificate of Incorporation

- Corporate Bylaws

- Submission of incorporation papers to the state

- Preparation and filing (with the IRS) of the Employer Identification Number (EIN) Application

STARTING AN ONLINE BUSINESS

If you are starting an online business, our law firm can help you throughout the entire process.

BUSINESS FORMATION WITH TRADEMARK REGISTRATION

When launching a US startup company, you can protect your business by registering US trademarks for your company name, logo and/or products. If you have a service-based company, you may wish to register a service mark.

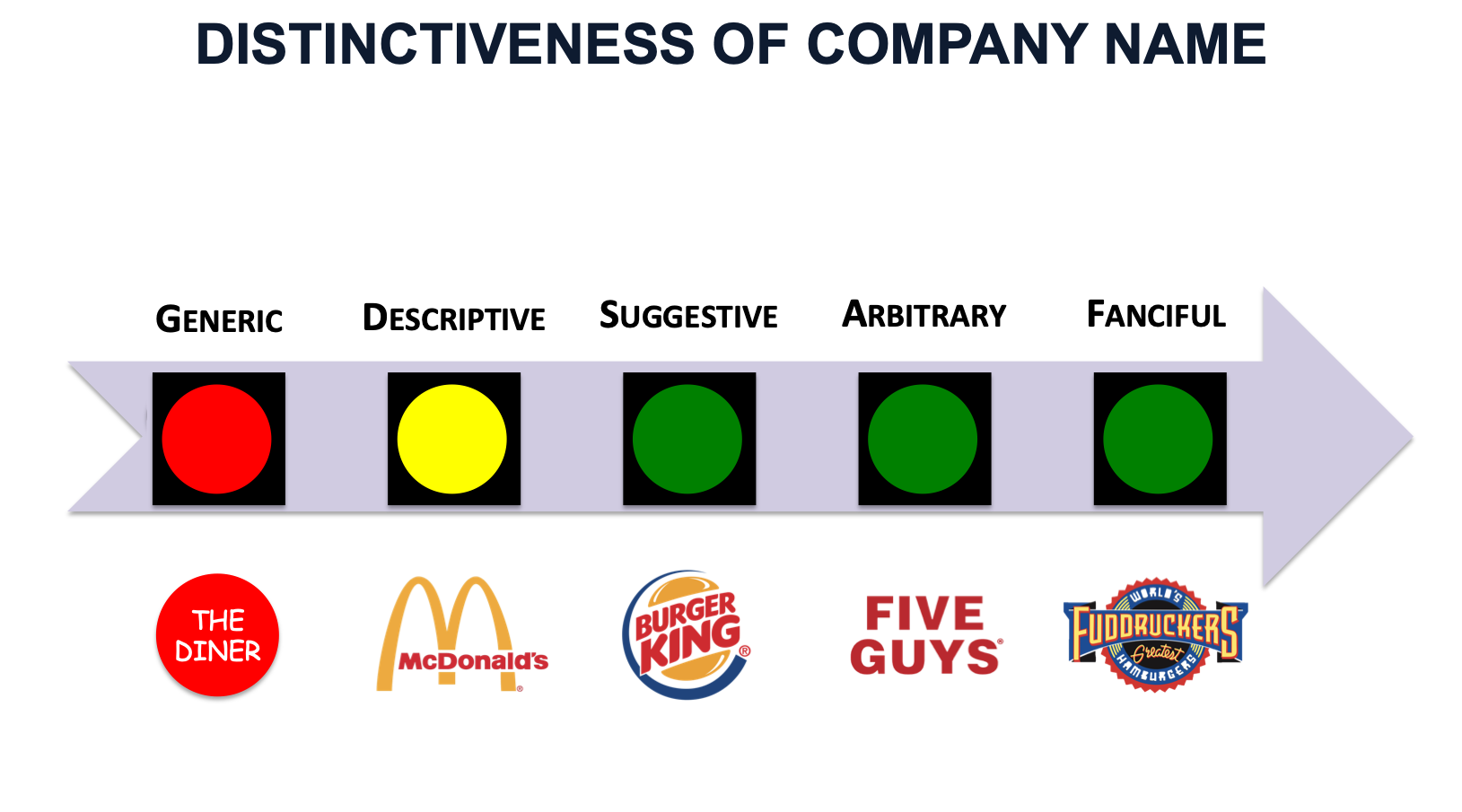

Your trademark must be distinct. Names that are more distinct (ie, fanciful, arbitrary and suggestive names) are more likely to get approved during the trademark application process. Inherently descriptive names are only eligible for registration as a trademark after they have achieved secondary meaning (ie, the company/product/service name has come to be closely associated which a particular source).

OUR TRADEMARKING SERVICES

Our lawyers will:

- Advise you on legal principles and requirements for creating and registering a trademark or service mark in the US

- Provide you with a search report describing potentially conflicting federal and common law trademarks. If significant conflicts are found for your proposed trademark, we will perform a second conflict search using a different proposed trademark.

- Prepare and file your US trademark application

Our lawyers will:

- Advise you on legal principles and requirements for creating and registering a trademark or service mark in the US

- Provide you with a search report describing potentially conflicting federal and common law trademarks. If significant conflicts are found for your proposed trademark, we will perform a second conflict search using a different proposed trademark.

- Prepare and file your US trademark application

Plus

- Guide you in the formulation of your positioning statement and brand personality

- Guide and collaborate with you in generating name candidates

- NORTH AMERICAN OFFICE

-

JORDAN COUNSEL LLC

30 Wall St., 8th Floor

New York, NY 10005

USA - +1 (212) 709-8098

- info@jordancounsel.com

- EUROPEAN OFFICE

-

JORDAN COUNSEL

Bossestr. 6b

10245 Berlin

GERMANY - +49 30 8442 9421

- info@jordancounsel.eu